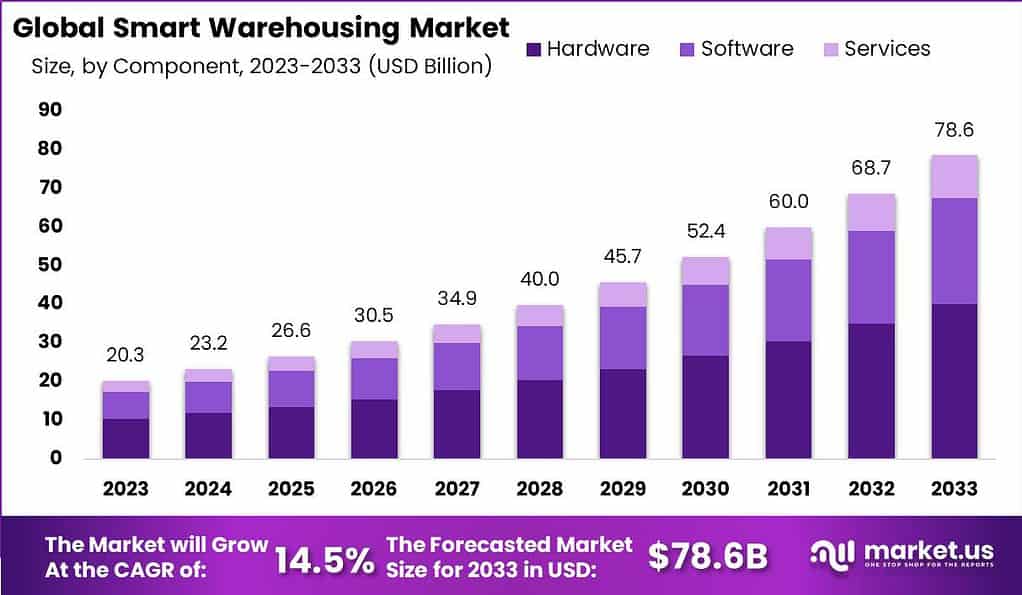

New York, Jan. 29, 2024 (GLOBE NEWSWIRE) -- According to Market.us, The Smart Warehousing Market is projected to have a moderate-paced CAGR of 14.5% during the forecast period (2024-2033). The current valuation of the smart warehousing industry is likely to USD 23.4 Billion in 2024. The demand for this market is anticipated to reach a high of USD 78.6 Billion by the year 2033.

The smart warehousing market represents a rapidly evolving segment within the logistics and supply chain industry, characterized by the integration of advanced technologies such as the Internet of Things (IoT), artificial intelligence (AI), robotics, and data analytics. These technologies have been instrumental in enhancing operational efficiency, accuracy, and speed in warehouse operations, catering to the increasing demands of e-commerce, retail, and manufacturing sectors.

Are you a start-up willing to make it big in the business? Grab an exclusive sample of this report here

Important Revelation:

- The Smart Warehousing Market is projected to grow at a CAGR of 14.5% from 2023 to 2033, with the market size expected to reach USD 78.6 billion by 2033, up from USD 20.3 billion in 2023.

- Component Analysis: In 2023, hardware components held the majority market share at over 51%. These components are crucial for capturing real-time data and enabling automation.

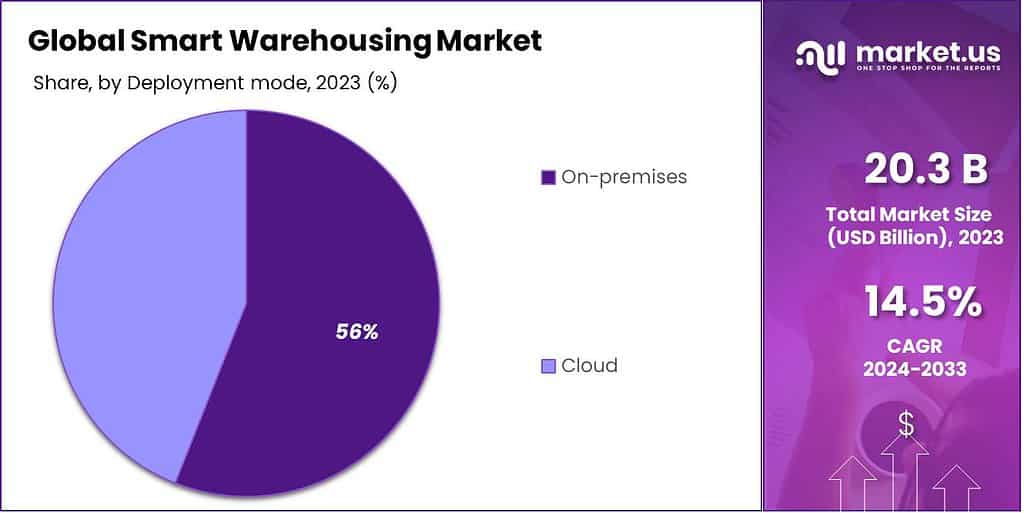

- Deployment Analysis: In 2023, on-premises solutions accounted for over 56% of the market, mainly due to enhanced control, customization, and reliability.

- Technology Analysis: In 2023, robotics and automation held more than 32% of the market share, offering efficiency gains and addressing labor shortages.

- Application Analysis: In 2023, the order fulfillment segment captured over 34% market share, driven by the need for rapid and accurate order processing, especially in e-commerce.

- Warehouse Size Analysis: In 2023, large warehouses held the largest market share at more than 48%, benefiting from advanced technologies to manage complex operations.

- Vertical Analysis: In 2023, the transportation and logistics segment accounted for over 19.5% of the market share, as smart warehousing optimizes supply chain operations.

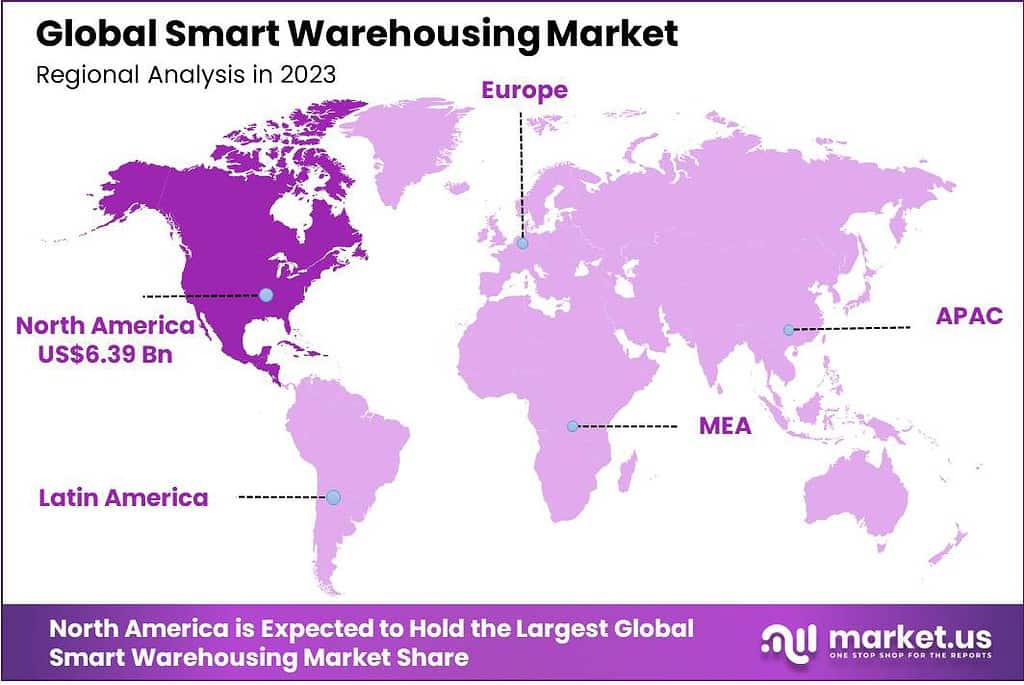

- Market Leadership: North America held a dominant market position in 2023, capturing more than a 31.5% share, primarily due to rapid adoption of advanced technologies in logistics and supply chain management.

Immediate Delivery Available | Buy This Premium Research Report@ https://market.us/purchase-report/?report_id=113020

Analyst's Perspective

The Smart Warehousing market is witnessing a notable surge in growth, driven by a confluence of technological advancements and evolving supply chain requirements. The driving factors behind this growth are multifaceted. Firstly, there is a growing adoption of automation technologies such as robotics, IoT (Internet of Things), and AI (Artificial Intelligence) in warehouse management, which significantly enhances efficiency and accuracy in inventory management and logistics. Additionally, the increasing demand for faster delivery times in the e-commerce sector is compelling warehouse operators to adopt smart technologies to streamline operations and reduce order fulfillment times.

The opportunities in the Smart Warehousing market are vast and varied. There is significant potential for growth in the development and deployment of advanced robotics solutions tailored to warehousing needs, offering precision and efficiency in material handling. The expansion of 5G networks presents opportunities for more connected and real-time operations in warehouses. According to Tidio, the number of online shoppers has risen significantly to over 2.14 billion, marking a substantial uptick in recent years. When considering the global population of 7.9 billion, this data underscores that 27% of individuals globally are participating in online purchasing.

Additionally, as businesses increasingly prioritize sustainability, there is a growing market for solutions that optimize energy use and reduce waste in warehouse operations. Furthermore, the ongoing trend towards omnichannel retailing is creating a demand for more integrated and flexible warehouse management systems. This market is also likely to benefit from increased investment in R&D, fostering innovation in areas like autonomous vehicles, drone technology, and AI-driven predictive analytics for inventory management.

Factors Affecting the Growth of the Global Smart Warehousing

- Technological Advancements: The rapid evolution of technologies such as the Internet of Things (IoT), Artificial Intelligence (AI), machine learning, and robotics plays a crucial role. These technologies enable smarter, more efficient warehouse operations, facilitating automation, real-time inventory tracking, predictive maintenance, and enhanced data analytics.

- E-commerce Growth: The burgeoning e-commerce sector significantly drives demand for smart warehousing. As online retailing grows, there is an increased need for warehouses to efficiently handle large volumes of orders, manage returns, and ensure timely delivery, all of which are facilitated by smart warehousing solutions.

- Supply Chain Optimization: Companies are increasingly focusing on optimizing their supply chains to reduce costs and improve efficiency. Smart warehousing offers solutions for better inventory management, space utilization, and logistics coordination, contributing to overall supply chain effectiveness.

- Labor Efficiency and Safety: The growing emphasis on labor efficiency and workplace safety is propelling the adoption of automated systems in warehouses. Robotics and AI-enabled systems can perform repetitive tasks, reduce human errors, and operate in environments that might be hazardous to human workers.

- Data-Driven Decision Making: The shift towards data-driven decision-making in business operations is a significant factor. Smart warehousing systems provide vast amounts of data that can be analyzed to forecast demand, optimize stock levels, and make informed strategic decisions.

The report provides a full list of key companies, their strategies, and the latest developments. Download a PDF Sample before buying

Top Key Players

The competitive landscape of the market has also been examined in this report. Some of the major players include:

- Honeywell International Inc.

- Siemens

- Zebra Technologies Corporation

- IBM Corporation

- Oracle Corporation

- SAP SE

- KION Group AG

- Cognex Corporation

- ABB Ltd.

- Tecsys, Inc.

- Manhattan Associates

- PSI Logistics

- Reply

Recent Developments

In 2023, Honeywell:

- Launched Honeywell Integrated Warehouse Platform (HIWP): Combines various software and hardware products (e.g., Honeywell Forge and Vuforia AR) for centralized control and optimization of warehouse operations.

- Partnerships:

- Collaborated with OTTO Motors to develop warehouse robotics solutions.

- Partnered with Microsoft to integrate Azure IoT and Dynamics 365 with Honeywell's warehouse solutions.

In 2023, IBM:

- Enhanced Supply Chain Optimization suite: Includes new AI-powered tools for demand forecasting, inventory optimization, and warehouse automation.

- Launched Sterling Warehouse Management System (WMS) on IBM Cloud: Enables scalable and flexible WMS deployment for improved warehouse efficiency.

In 2023, SAP:

- Launched SAP Logistics Cloud Warehouse Management: Cloud-based WMS offering improved analytics and integration with other SAP solutions.

- Enhanced SAP Intelligent Robotic Warehouse Manager: Empowers warehouses with machine learning for optimized inventory management and robotic control.

Scope of the Report

| Report Attributes | Details |

| Market Value (2023) | USD 20.3 Billion |

| Forecast Revenue 2033 | USD 78.6 Billion |

| CAGR (2023 to 2032) | 14.5% |

| North America Revenue Share | 31.5% |

| Base Year | 2023 |

| Historic Period | 2018 to 2022 |

| Forecast Year | 2024 to 2033 |

Plan your Next Best Move. Purchase the Report for Data-driven Insights: https://market.us/purchase-report/?report_id=113020

Report Segmentation

Component Analysis

In 2023, the Hardware segment held a dominant market position in the Smart Warehousing market, capturing more than a 51% share. This substantial market share can be attributed to the critical role of hardware components in the functionality of smart warehouses. Hardware elements such as sensors, RFID tags, robots, and automated material handling equipment are fundamental in establishing a smart warehousing infrastructure. These components are essential for automating processes, ensuring real-time tracking of inventory, and facilitating efficient warehouse operations.

Furthermore, the increasing adoption of IoT and AI technologies in warehousing operations has further bolstered the demand for sophisticated hardware systems. For instance, IoT sensors are instrumental in monitoring environmental conditions and tracking product movement, while automated guided vehicles (AGVs) and robots streamline material handling and order fulfillment processes. The integration of these hardware technologies not only improves operational efficiency but also significantly reduces the likelihood of errors and enhances workplace safety.

Deployment Analysis

In 2023, the On-Premises segment held a dominant market position in the Smart Warehousing market, capturing more than a 56% share. This prominence of the On-Premises deployment can be largely attributed to the specific requirements and preferences of warehousing operations, particularly regarding security, control, and integration with existing systems. On-Premises solutions offer a high level of data security, a critical factor for many businesses that handle sensitive inventory or confidential customer information. These systems store data internally within the company's network, providing businesses with complete control over their data and reducing the risk of data breaches common in external networks.

Moreover, On-Premises deployment allows for better integration with legacy systems and hardware commonly found in warehouses. This seamless integration is vital for many businesses that rely on established processes and cannot afford the downtime or resource investment needed to migrate to cloud-based systems. Additionally, On-Premises solutions enable warehouse operators to customize their systems to specific operational needs, providing a tailored approach that many businesses find valuable.

Technology Analysis

In 2023, the Robotics and Automation segment held a dominant market position in the Smart Warehousing market, capturing more than a 32% share. This leading position can be attributed to the pivotal role of robotics and automation technologies in revolutionizing warehouse operations. These technologies have become integral in enhancing efficiency, accuracy, and speed in warehousing tasks such as sorting, packing, transporting, and storing goods.

The increasing demand for quicker order fulfillment driven by the e-commerce boom has been a major catalyst for the adoption of robotics and automation. Automated Guided Vehicles (AGVs), robotic arms, and conveyor belt systems are now commonplace in modern warehouses, significantly reducing manual labor and the associated risks and inefficiencies. These technologies have enabled warehouses to operate round-the-clock, further increasing productivity.

Application Analysis

In 2023, the Order Fulfillment segment held a dominant market position in the Smart Warehousing market, capturing more than a 34% share. This significant share is primarily due to the escalating demands of e-commerce, which require rapid, accurate, and efficient order processing. Smart warehousing technologies have become essential in meeting these demands, optimizing the order fulfillment process through automation and precision.

The integration of technologies such as robotics, AI, and IoT in order fulfillment enables warehouses to handle large volumes of orders with greater speed and fewer errors. Automated systems, such as robotic pickers and sorters, streamline the picking and packing process, significantly reducing the time from order receipt to dispatch. These technologies also support the handling of a wide range of product types and sizes, enhancing the flexibility and scalability of warehouse operations.

Request Sample Report and Drive Impactful Decisions: https://market.us/report/smart-warehousing-market/request-sample/

Warehouse Size Analysis

In 2023, the Large segment held a dominant market position in the Smart Warehousing market, capturing more than a 48% share. This prominence is primarily due to the extensive adoption of smart warehousing solutions by large-scale operations, which often manage complex and high-volume inventory and order fulfillment processes. Large warehouses, typically utilized by major e-commerce retailers, manufacturers, and logistics companies, require sophisticated systems to efficiently handle their expansive and diverse inventory.

The implementation of smart warehousing technologies in large warehouses significantly enhances operational efficiency, accuracy, and speed. These facilities often deploy advanced robotics and automation systems, IoT for real-time tracking, and AI-driven analytics for optimizing inventory management and logistics. The scale of these operations justifies the higher investment in smart warehousing solutions, as the benefits in terms of improved throughput, reduced error rates, and lower labor costs are considerable.

Vertical Analysis

In 2023, the Transportation & Logistics segment held a dominant market position in the Smart Warehousing market, capturing more than a 19.5% share. This leading position can be attributed to the critical role that smart warehousing plays in the efficiency and effectiveness of transportation and logistics operations. In an industry where timing, accuracy, and efficiency are paramount, smart warehousing technologies provide significant advantages.

The transportation and logistics industry relies heavily on warehousing for storing and managing goods in transit. The adoption of smart warehousing solutions in this sector has led to substantial improvements in inventory management, order processing, and delivery times. Technologies such as automated material handling equipment, real-time tracking systems, and advanced robotics are integral in optimizing warehouse operations, leading to quicker turnaround times and reduced bottlenecks.

Key Market Segments

By Component

- Hardware

- Software

- Services

By Deployment

- Cloud

- On-Premises

By Technology

- IoT

- Robotics and Automation

- AI and Analytics

- Networking and Communication

- AR and VR

- Others

By Application

- Inventory Management

- Order Fulfillment

- Asset Tracking

- Others

By Warehouse Size

- Small

- Medium

- Large

By Vertical

- Retail & E-commerce

- Manufacturing

- Transportation & Logistics

- Food & Beverages

- Healthcare

- Energy and Utilities

- Agriculture

- Others

Drivers:

A key driver for the Global Smart Warehousing market is the exponential growth of the e-commerce industry. The surge in online shopping has necessitated advancements in warehousing technology to manage increased order volumes, ensure rapid delivery, and maintain inventory accuracy. This demand has propelled the integration of smart technologies like robotics, AI, and IoT in warehousing operations, streamlining processes and enhancing efficiency.

Restraint:

Conversely, a significant restraint in this market is the high initial investment required for implementing smart warehousing solutions. The cost of advanced technologies such as automated systems, sophisticated software for inventory management, and IoT devices can be prohibitive, especially for small and medium-sized enterprises. This financial barrier can slow down the adoption rate of smart warehousing technologies.

Opportunity:

An opportunity in the smart warehousing market lies in the increasing emphasis on sustainability and energy efficiency. Warehouses are exploring ways to reduce their carbon footprint, leading to the development and adoption of green warehousing solutions. This includes energy-efficient lighting and machinery, solar panels, and systems for waste reduction and recycling, aligning operational efficiency with environmental responsibility.

Challenge:

A challenge facing the smart warehousing market is the integration and compatibility of various technologies. As warehouses adopt a multitude of systems and devices from different vendors, ensuring seamless integration and interoperability becomes a complex task. This challenge is compounded by the need for continuous updates and maintenance to keep up with technological advancements, requiring ongoing technical expertise and resources.

Regional Analysis

In 2023, North America held a dominant market position in the Smart Warehousing market, capturing more than a 31.5% share. This leading stance is attributed to the region's rapid adoption of advanced technologies and the significant presence of key players in the smart warehousing domain. North America, particularly the United States, is home to a robust e-commerce sector, which drives the demand for efficient warehousing solutions. The region's emphasis on innovation and technological adoption in industries like retail, manufacturing, and logistics further contributes to its market dominance.

Europe follows closely, with a significant market share, driven by its strong focus on automation and efficiency in logistics and supply chain operations. European countries have been early adopters of technologies like IoT and robotics in warehousing, propelled by a skilled workforce and supportive government policies aimed at digital transformation.

Key Regions and Countries Covered in this Report:

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Explore Extensive Ongoing Coverage on Technology and Media Reports Domain:

- Insurance Software Market is anticipated to capture a valuation of USD 6.6 Billion by 2033, grow at a CAGR of 6.6% during forecast period.

- Robot Software Market is anticipated to capture a valuation of USD 120.5 Billion by 2033, robust CAGR of 22.0% from 2024 to 2033.

- Collaborative Robots Market is projected to reach a valuation of USD 23.5 Bn by 2033 at a CAGR of 31.7%, from USD 1.5 Bn in 2023.

- Smart Mobility Market is anticipated to capture a valuation of USD 264.1 Billion by 2033 with a CAGR of 20.1% during the forecast period.

- Cable Management Systems Market is anticipated to be USD 61.1 billion by 2033. It is estimated to record a steady CAGR of 9.7%.

- Smart Card Market is anticipated to be USD 29.6 billion by 2033. It is estimated to record a steady CAGR of 5.9% in the forecast period.

- Assistive Technology Market is anticipated to be USD 36.6 bn by 2033. It is estimated to record a steady CAGR of 4.8% in forecast period.

- Remote Sensing Technology Market size is expected to be worth around USD 61.7 Billion by 2032, record a steady CAGR of 19.0%.

- Supply Chain Digital Twin Market projected to be valued at USD 8.7 billion in 2033, growing at a CAGR of 12.0% during the forecast period.

- Restaurant Management Software Market size is expected to be worth around USD 26.3 Billion by 2033, growing at a CAGR of 16.5%

- WiFi 6, WiFi 6E and WiFi 7 Chipset Market size is expected to be worth around USD 101.0 Billion by 2033, growing at a CAGR of 14.6%.

- Generative AI in Fintech Market will exceed USD 6,256 million by 2032, rising from USD 865 million in 2022; at a CAGR of 22.5%.

- Enterprise Blockchain Market was valued at USD 9.6 Bn in 2023. It's predicted to increase and become worth USD 287.8 Billion by 2032.

- Capacitive Sensors Market is anticipated to be USD 74.3 bn by 2033. It is estimated to record a steady CAGR of 7.1% in the forecast period.

- Airline boarding passes market was valued at USD 4.5 bn in 2023. It is estimated to reach USD 9.1 bn at a CAGR of 7.5% from 2023-32.

- Patrol Boats Market is projected to reach a revised size of USD 40,538.3 Mn by 2032, growing at a CAGR of 6.7%.

About Us

Market.US (Powered by Prudour Pvt Ltd) specializes in in-depth market research and analysis and has been proving its mettle as a consulting and customized market research company, apart from being a much sought-after syndicated market research report-providing firm. Market.US provides customization to suit any specific or unique requirement and tailor-makes reports as per request. We go beyond boundaries to take analytics, analysis, study, and outlook to newer heights and broader horizons.

Follow Us On LinkedIn Facebook Twitter

Our Blog: