Dublin, March 06, 2024 (GLOBE NEWSWIRE) -- The "Forage Seeds Market Size and Forecasts 2020-2030, Global and Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Type [Alfalfa, Clover, Ryegrass, Timothy, Sorghum, Brome, Birdsfoot Trefoil, Cowpea, Meadow Fescue, and Others], Category, and Livestock" report has been added to ResearchAndMarkets.com's offering.

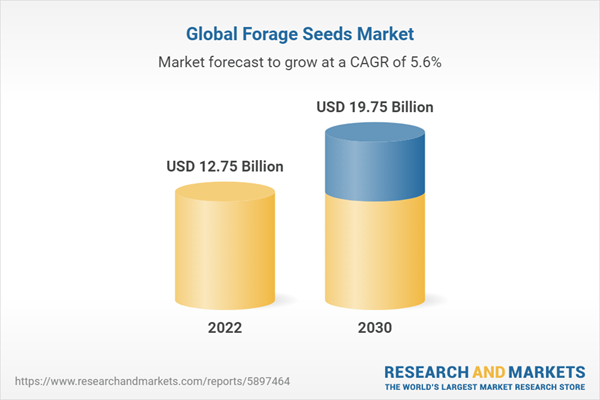

The forage seeds market is expected to grow from US$ 12.75 billion in 2022 to US$ 19.75 billion by 2030; it is expected to record a CAGR of 5.6% from 2022 to 2030.

People are becoming more conscious about their health; thus, they prefer consuming organic food as it does not contain pesticides. Organic milk and meat are richer in nutrients such as enzymes, bioflavonoids, and antioxidants. Hence, people prefer organic food and organic meat over inorganic. This has led to the demand for organic feed to supply organic meat to consumers. Dairy farms, the poultry sector, and animal husbandry have focused on purchasing high-quality organic forage feed due to the growing demand for organic meat and dairy products.

Conventional feed often contains high amounts of chemicals that hamper meat quality when consumed by animals. Long-term consumption of such meat results in various health disorders. To overcome this issue, manufacturers are developing organic feed that contains no chemical additives.

Animals feeding on such feed offer meat that has high nutritional value. Thus, consumers often find organic and natural products as healthier alternatives to conventional products. Consumers are mainly inclined toward organic products, which has encouraged manufacturers to invest heavily in products produced with organic constituents. Furthermore, the more accessible access to infinite information with the help of the internet has made consumers increasingly aware of their health needs, leading to the increasing demand for organic feed. Thus, a rising preference for organic feed is expected to become a significant trend in the forage seeds market during the forecast period.

Based on type, the forage seeds market is segmented into [alfalfa, clover (white, red, hybrid, and others), ryegrass (annual ryegrass, perennial ryegrass, Italian ryegrass, and hybrid ryegrass), timothy, sorghum, brome, birdsfoot trefoil, cowpea, meadow fescue, and others]. The alfalfa segment is projected to register the largest share during the forecast period. The US is one of the largest producers of alfalfa across the globe, followed by Argentina, Australia, South & North Africa, and Southern Europe. According to the United States Department of Agriculture (USDA), the exports of alfalfa hay account for ~40% of the total US hay exports. Alfalfa is known as the "Queen of Forages" due to its high nutrient content, higher yield, and easy adaptability. The meat and dairy industries are essential consumers of alfalfa forage as it is one of the significant sources of nutrients such as protein, minerals, and fibers for ruminants. The rising demand for alfalfa hay in the meat and dairy industry is one of the major factors bolstering the demand for alfalfa seeds globally.

By geography, the forage seeds market is primarily segmented into North America, Europe, Asia Pacific (APAC), the Middle East & Africa (MEA), and South & Central America. In 2022, North America held the largest market share during the forecast period. However, Asia Pacific is a fastest growth region. The Asia Pacific forage seeds market is segmented into China, Japan, India, Australia, South Korea, and the Rest of Asia Pacific. The market in the region is expected to grow during the forecast period due to rising animal feed production and the growing livestock industry. Asia Pacific is the largest producer of animal feed globally. According to Alltech Global, the region produced over 305 million metric tons of animal feed in 2020. Further, it houses some major animal stock farming countries, accelerating the demand for animal feed additives in the region. India houses the largest livestock population. Thus, the demand for animal feed, such as forage, is high in India. However, the production is low due to the unorganized market and minimum awareness about forages. Thus, the country imports forages from other countries such as China, the US, and Italy.

Asia Pacific accounts for the largest human population among all five regions and contains ~60% of the global population. Hence, the region is witnessing strong demand for meat and dairy products, leading the region for livestock production, and subsequently favoring the demand for animal feed. The mass consumption of animal feed in the region and increasing practices of feeding nutritious feed to livestock are fueling the growth of the forage seeds market in the region.

The leading players in the forage seeds market are UPL Ltd, DLF Seeds AS, Corteva Inc, Limagrain UK Ltd, S&W Seed Co, Deutsche Saatveredelung AG, Cerience, Allied Seed LLC, MAS Seeds SA, Syngenta AG These players are developing various products to address consumers' growing demand.

Reasons to Buy

- Highlights key business priorities in order to assist companies to realign their business strategies.

- The key findings and recommendations highlight crucial progressive industry trends in the global forage seeds market, thereby allowing players to develop effective long-term strategies.

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets.

- Scrutinize in-depth the market trends and outlook coupled with the factors driving the market, as well as those hindering it.

- Enhance the decision-making process by understanding the strategies that underpin commercial interest with respect to products, segmentation, and industry verticals.

Key Attributes

| Report Attribute | Details |

| No. of Pages | 200 |

| Forecast Period | 2022-2030 |

| Estimated Market Value (USD) in 2022 | $12.75 Billion |

| Forecasted Market Value (USD) by 2030 | $19.75 Billion |

| Compound Annual Growth Rate | 5.6% |

| Regions Covered | Global |

Key Topics Covered:

1. Introduction

1.1 Report Guidance

1.2 Market Segmentation

2. Executive Summary

2.1 Key Market Insights

2.2 Market Attractiveness

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

3.4 Limitations and Assumptions:

4. Forage Seeds Market Landscape

4.1 Overview

4.2 Porter's Five Forces Analysis

4.2.1 Bargaining Power of Suppliers

4.2.2 Bargaining Power of Buyers

4.2.3 Threat of New Entrants

4.2.4 Competitive Rivalry

4.2.5 Threat of Substitutes

4.3 Ecosystem Analysis

4.3.1 Raw Material Suppliers

4.3.2 Manufacturing Process

4.3.2.1 Pre-Planting Activities

4.3.2.2 Post-planting activities

4.3.3 Distributors or Suppliers

4.3.4 End User

4.4 List of Vendors

5. Forage Seeds Market - Key Market Dynamics

5.1 Market Drivers

5.1.1 Increasing Livestock Production

5.1.2 Strategic Development Initiatives

5.2 Market Restraints

5.2.1 Unorganized Market in Developing Countries

5.3 Market Opportunities

5.3.1 Technological Improvement for Seed Genetics

5.4 Future Trends

5.4.1 Rising Preference for Organic Feed

5.5 Impact Analysis of Drivers and Restraint

6. Forage Seeds Market - Global Market Analysis

6.1 Forage Seeds Market Revenue (US$ Million)

6.2 Forage Seeds Market Forecast and Analysis (2020-2030)

7. Forage Seeds Market Analysis - Type

7.1 Alfalfa

7.2 Clover

7.3 Ryegrass

7.4 Timothy

7.5 Sorghum

7.6 Brome

7.7 Birdsfoot Trefoil

7.8 Cowpea

7.9 Meadow Fescue

7.10 Others

8. Forage Seeds Market Revenue Analysis - By Category

8.1 Overview

8.2 Organic

8.3 Conventional

9. Forage Seeds Market Revenue Analysis - By Livestock

9.1 Overview

9.2 Ruminants

9.3 Poultry

9.4 Swine

9.5 Others

10. Ryegrass Type - by Maturity Stage and Ploid

11. Forage Seeds Market - Geographical Analysis

11.1 North America

11.2 Europe

11.3 Asia Pacific Forage Seeds Market

11.4 Middle East & Africa

11.5 South & Central America

12. Impact of COVID-19 Pandemic on Global Forage Seeds Market

12.1 Pre & Post COVID-19 Impact on Forage Seeds Market

13. Industry Landscape

13.1 Overview

13.2 Merger and Acquisition

13.3 Partnerships

14. Competitive Landscape

14.1 Heat Map Analysis by Key Players

14.2 Company Positioning & Concentration

15. Company Profiles

15.1 UPL Ltd.

15.2 DLF Seeds AS

15.3 Corteva Inc.

15.4 Limagrain UK Ltd.

15.5 S&W Seed Co.

15.6 MAS Seeds SA

15.7 Syngenta AG

15.8 Deutsche Saatveredelung AG

15.9 Cerience

15.10 Allied Seed LLC

For more information about this report visit https://www.researchandmarkets.com/r/yszhdm

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment